All-in-one package to run your exchange marketplace

Our exchange solution allows you launch your exchnage quickly focus on growing your marketplace rather than compromize due to technology challenges

Powerful

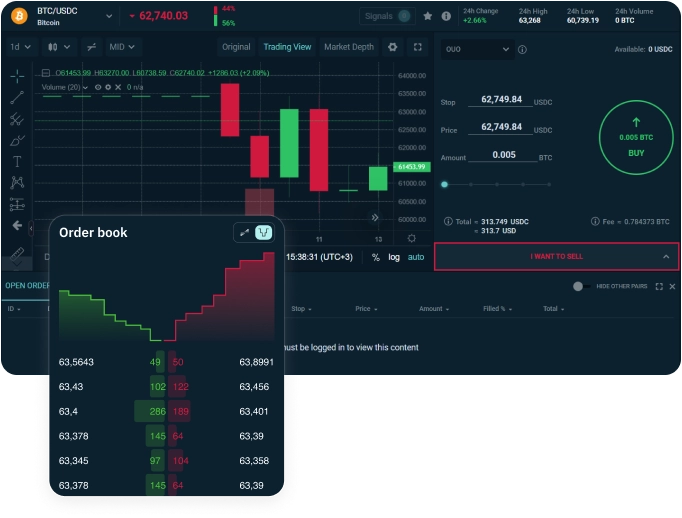

Central Limit Order Book (CLOB)

High Performance Matching Engine

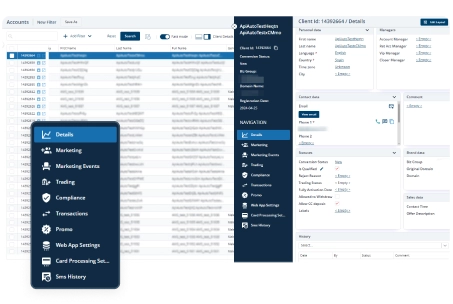

Back end with Administrative Interfaces

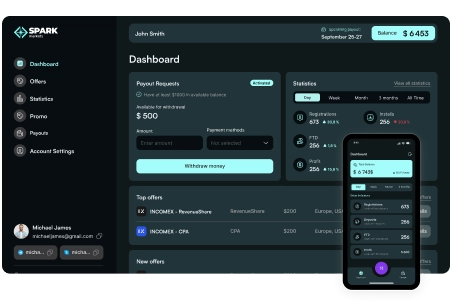

Provides advanced tools to your Sales and Retention teams

Manage Risk and Exposures an all levels

KYC and AML automation and workflow support

Sophisticated MarketMaker toolsuitet

Enhanced Reporting for all workflows

The SparkMarkets Exchange Advantage

Everything you need to launch your marketplace in one package

Our solution can adapt and accomodate the widest variet of trading contracts

Our solution is intended for an unintemediated exchange where clients accounts are opened with the marketplace directly

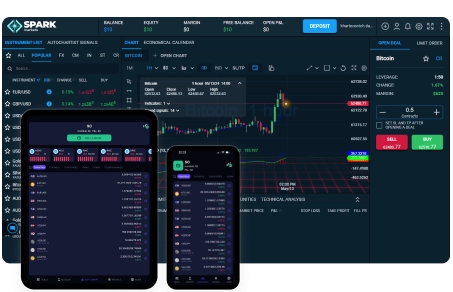

Our solution can easily scale from hundereds to hundreds of thousands accounts, withouct security compromises

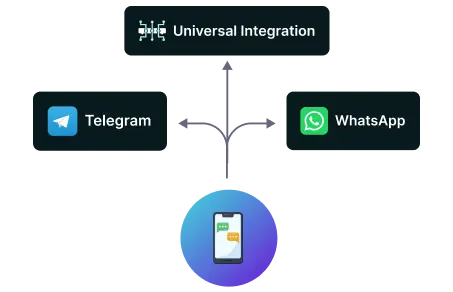

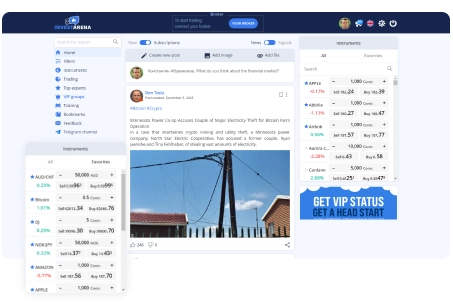

Marketplace features intuitive, user-friendly trading interfaces compatible with almost any device

The systems can be installed on your servers or an the cloud, or both as needed

We have every component necessary for you to go live quickly

Our turnkey solution covers websites, backends, frontends, and market maker tools

Exchange featuring your logo and personalized trading layouts

- Setting up Stop Loss/Take Profit levels in advance during order placement

- A Trading Dashboard to analyze trading performance

- A Trading Journal for organizing trading strategies and plans

- A sophisticated charting tool for technical analysis

Faq

The exchange marketplace takes the privacy and security of user data very seriously. The platform employs advanced encryption technologies, secure data storage, and other measures to protect the confidentiality of participant information.

In the event of a system outage or technical issue on the exchange marketplace, the platform has contingency plans in place to ensure the continued operation of the marketplace. This may include the activation of backup systems, the implementation of trading halts, and the communication of relevant information to participants.

The exchange marketplace is committed to operating in compliance with all applicable laws and regulations. The system supports robust compliance measures, including know-your-customer (KYC) and anti-money laundering (AML) checks, as well as ongoing monitoring and reporting to regulatory authorities.

The exchange marketplace offers a range of risk management tools to help participants manage their exposure, including order size limits, stop-loss orders, and margin requirements. The platform also has safeguards in place to mitigate the risk of market manipulation and other disruptive trading activities.

The settlement process for trades on the Exchange marketplace involves the transfer of the financial instrument and corresponding payment between the buyer and seller. The specific settlement timelines and procedures are outlined in the platform's user documentation and may vary depending on the type of financial instrument traded.

If you suspect any suspicious activity or potential market manipulation on the exchange, you should report it to the exchange's compliance or security team. This helps the exchange maintain the integrity of the market and protect users from fraudulent or manipulative practices.

The exchange supports a range of fiat currencies and cryptocurrencies for trading and deposit/withdrawal purposes. The specific list of supported assets may vary, so it's important to check the exchange's website or documentation.

Many exchanges provide educational resources, such as tutorials, webinars, or a knowledge base, to help users understand the platform, trading concepts, and market dynamics. You can typically access these resources through the exchange's website or within the trading platform.

If you have a dispute or issue with the exchange, there is typically a dispute resolution process that you can follow. This may involve contacting customer support, submitting a formal complaint, or escalating the issue to a higher authority, depending on the exchange's policies.

Many exchanges offer the ability to set up price alerts or notifications for specific assets or market conditions. This can help you stay informed about price movements and make timely trading decisions.

Get in Touch

Leave us a request for connection and we will contact you, as soon as possible