Everything you need to run your business in one powerful and secure system

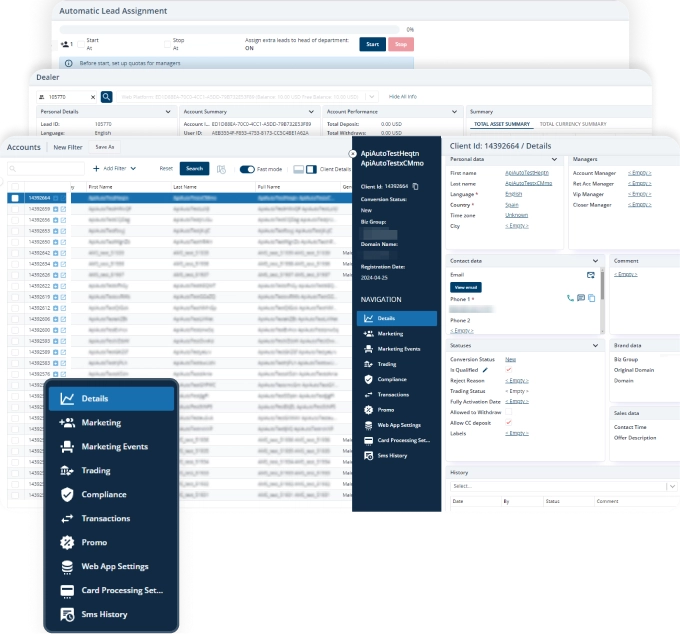

Our ERP includes a feature rich CRM which allows you to manage all key functions within your brokerage business. Determine the KPI of every facet of your operation and use data driven decisions to grow your business and your profitability.

Everything you need

Manage client onboarding

Track and optimize your marketing

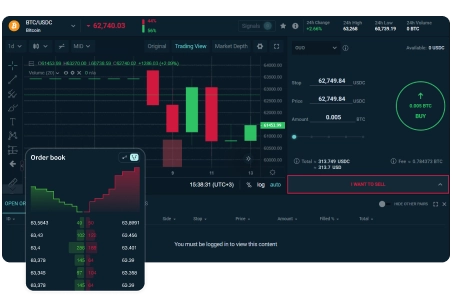

Set Trading Platform features and account settings

Advanced tools to your Sales and Retention teams

Control Risk and Exposures on all levels

KYC and AML automation and workflow support

Payment processing integrations and workflow management

Latest generation information security features

Why chose the SparkMarkets ERP/CRM

Assign varying access rights to ensure client data confidentiality. Restrict access, including with two-factor authentication, and log all system interactions

Flexible CRM settings will help create a convenient space for efficient work

Manage multiple brands across desks/brands/locales

The system can be adjusted to suit any business structure, even if unconventional

Our CRM boasts an intuitive interface that reduces the learning curve for your team and accelerates adoption

The platform can be installed on your servers, which increases data security and gives the broker full control over the software

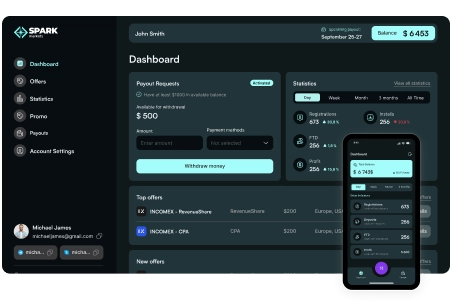

Boost your results with the SparkMarkets CRM

Of teams improved their performance after using a CRM system

The average percentage increase in deposit conversions using CRM

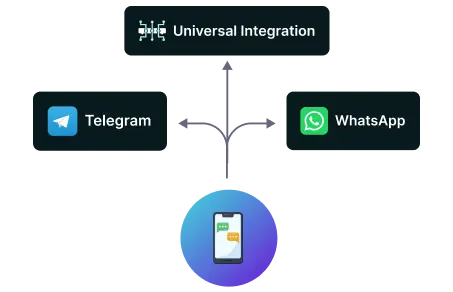

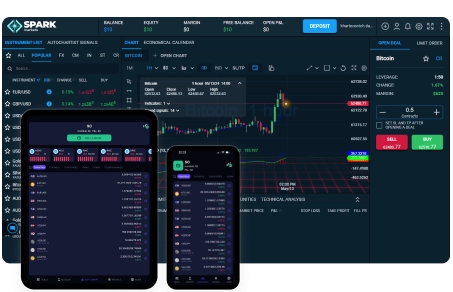

We support integrations with leading platforms

A few simple steps to connect the system

Leverage the power of our system with the available external integrations

- Platforms: leading Trading Platforms by other providers

- Communications: Google Workspace, VOIP Click2Call, Telegram, WhatsApp and more

- Payments: Over 200 PSP options to choose from, PCI DSS Cert. Lvl 1 for Credit Card Payments

- Analytics: Microsoft BI

- Hosting and scalability: Amazon Web Services

- KYC and Background Checks: Sum&Substance Automation

Integrates with 150+ payment gateways and crypto wallets

Faq

Best practices for managing CRM vendor relationships include:

- Clearly defining the scope of the CRM project and the expected deliverables

- Conducting thorough due diligence on the CRM vendor\'s capabilities and track record

- Negotiating favorable contract terms, including service-level agreements (SLAs)

- Establishing open communication channels and regular progress reviews

- Collaborating with the vendor to address any issues or challenges that arise

- Evaluating the vendor\'s responsiveness and commitment to the FX brokerage firm\'s success

To ensure the ongoing maintenance and optimization of the CRM system, FX brokerage firms should:

- Regularly review and update CRM processes and workflows to align with evolving business needs

- Continuously monitor CRM performance and user adoption metrics

- Collaborate with the CRM provider to stay informed about product updates and new features

- Allocate resources for CRM system maintenance, upgrades, and troubleshooting

- Establish a CRM governance committee to oversee the system\'s strategic direction and implementation

FX brokerage firms should consider the following regulatory aspects when implementing a CRM system:

- Compliance with data protection regulations (e.g., GDPR, FINRA) regarding client data privacy and security

- Adherence to record-keeping requirements for client interactions and transactions

- Ensuring the CRM system supports the firm\'s anti-money laundering (AML) and know-your-customer (KYC) procedures

- Integrating the CRM with the firm\'s risk management and compliance monitoring processes

FX brokerage firms can leverage CRM analytics to:

- Identify trends and patterns in client behavior and trading activity

- Analyze the effectiveness of marketing campaigns and sales strategies

- Forecast client churn and proactively address retention risks

- Optimize resource allocation and staffing based on workload and productivity

- Make informed decisions about product development, pricing, and service offerings

Best practices include:

- Maintaining up-to-date client profiles and communication records

- Proactively reaching out to clients with relevant information and updates

- Responding promptly to client inquiries and addressing their concerns

- Identifying and addressing client pain points to enhance their experience

- Regularly reviewing and updating the client relationship management strategy

FX brokerage firms can leverage CRM data to:

- Segment clients based on their trading behavior, preferences, and profitability

- Develop targeted marketing campaigns and personalized offers

- Identify cross-selling and upselling opportunities

- Optimize the sales process and improve lead conversion rates

- Analyze client lifetime value and focus on high-value customer retention

Key considerations for CRM integration include:

- Identifying the critical systems (e.g., trading platforms, accounting software) that need to be connected

- Evaluating the compatibility and data exchange requirements between the CRM and other systems

- Developing a comprehensive integration strategy and implementation plan

- Ensuring seamless data synchronization and minimizing manual data entry

- Providing training and support for users on the integrated workflows

To ensure data quality and integrity, FX brokerage firms should:

- Establish clear data governance policies and procedures

- Implement data validation and cleansing processes

- Provide training on data entry best practices for CRM users

- Regularly audit and monitor CRM data for accuracy and completeness

- Integrate the CRM with other systems to minimize data silos and inconsistencies

Best practices for CRM user training and onboarding include:

- Providing comprehensive training sessions covering CRM functionality and workflows

- Developing user guides, tutorials, and knowledge base resources

- Designating CRM champions or super-users to provide ongoing support and guidance

- Offering refresher training and updates as the CRM system evolves

- Encouraging user feedback and incorporating it into the training program

FX brokerage firms can measure the success of their CRM implementation by tracking key performance indicators (KPIs) such as:

- Client satisfaction and retention rates

- Lead conversion and sales pipeline metrics

- Productivity and efficiency gains for sales and support teams

- Reduction in manual data entry and administrative tasks

- Improved data-driven decision making and strategic planning

Get in Touch

Leave us a request for connection and we will contact you, as soon as possible